cryptocurrency tax calculator australia

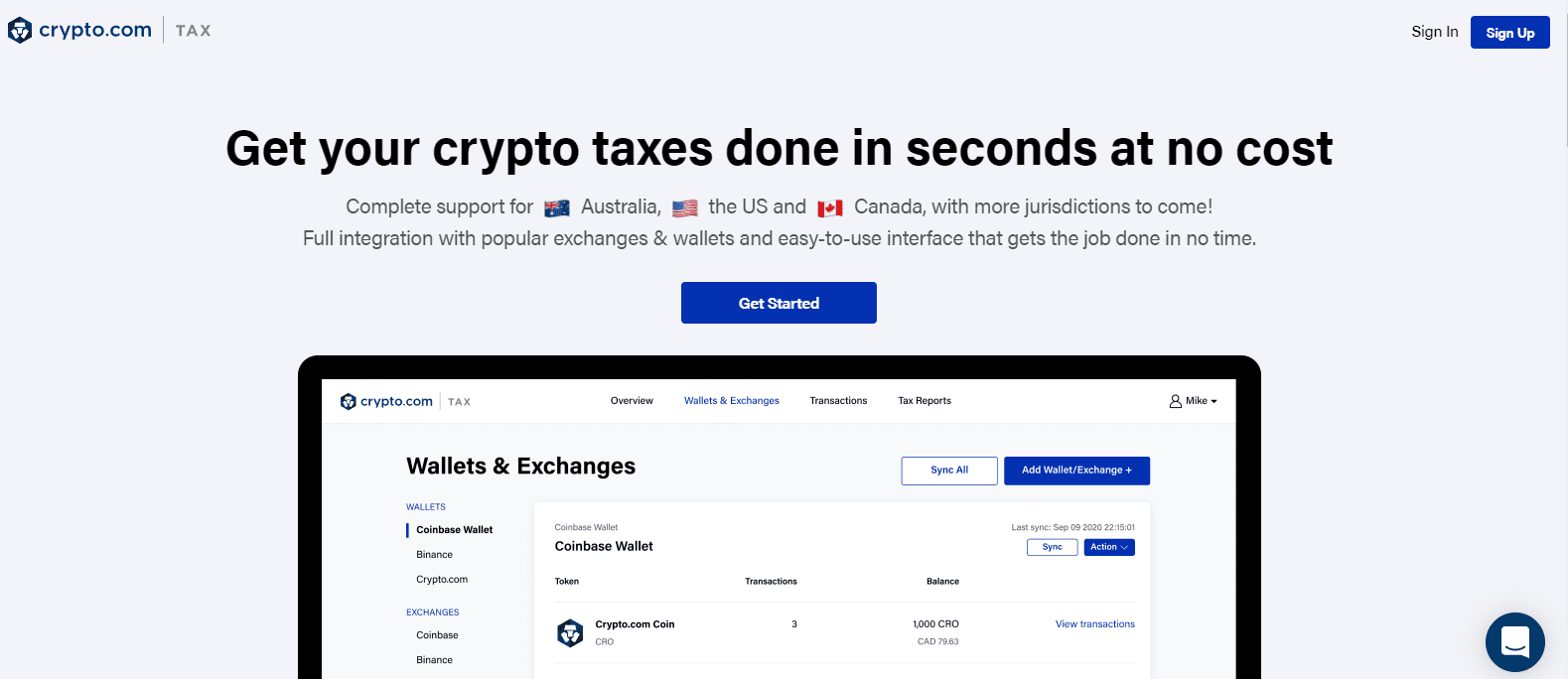

Crypto Tax Calculator Australia prides itself on making it simple to use our service when it comes to calculating your cryptocurrency tax. It flawlessly tracks all of your wallet transactions like capital gains capital losses and exchanges.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

In Australia your crypto investment is generally subject to Capital Gains Tax.

. Their plans start at only 50 per year on a subscription basis. BearTax - Calculate File Crypto Taxes in Minutes. Overall Koinly is the best cryptocurrency tax software for Australians to stay compliant with the Australian Tax Office ATO.

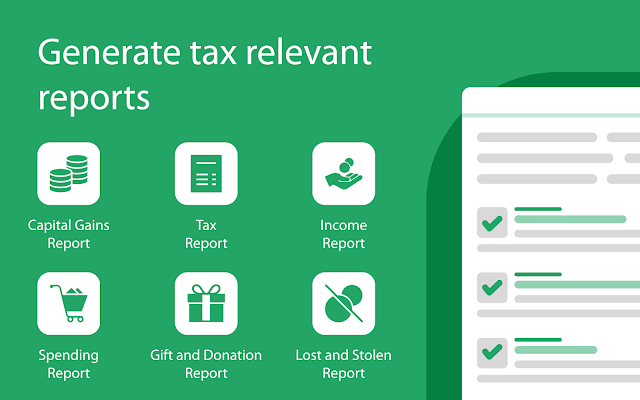

Their platform integrates with the most exchanges and NFT DeFi and Decentralised Exchange DEX platforms to generate a simple and accurate tax report. Tailored as per the ATO guidelines the algorithm provides an accurate report of your crypto gainslosses for a financial year. Compliant with Australian tax rules Free report preview Over 600 Integrations incl.

Get Started For Free See our 500 reviews on. You report capital gains and losses within your Income Tax Return and pay Income Tax on any net gains. For more information on the first steps to getting your cryptocurrency tax calculated in Australia see the below useful articles we have created to help you get things underway.

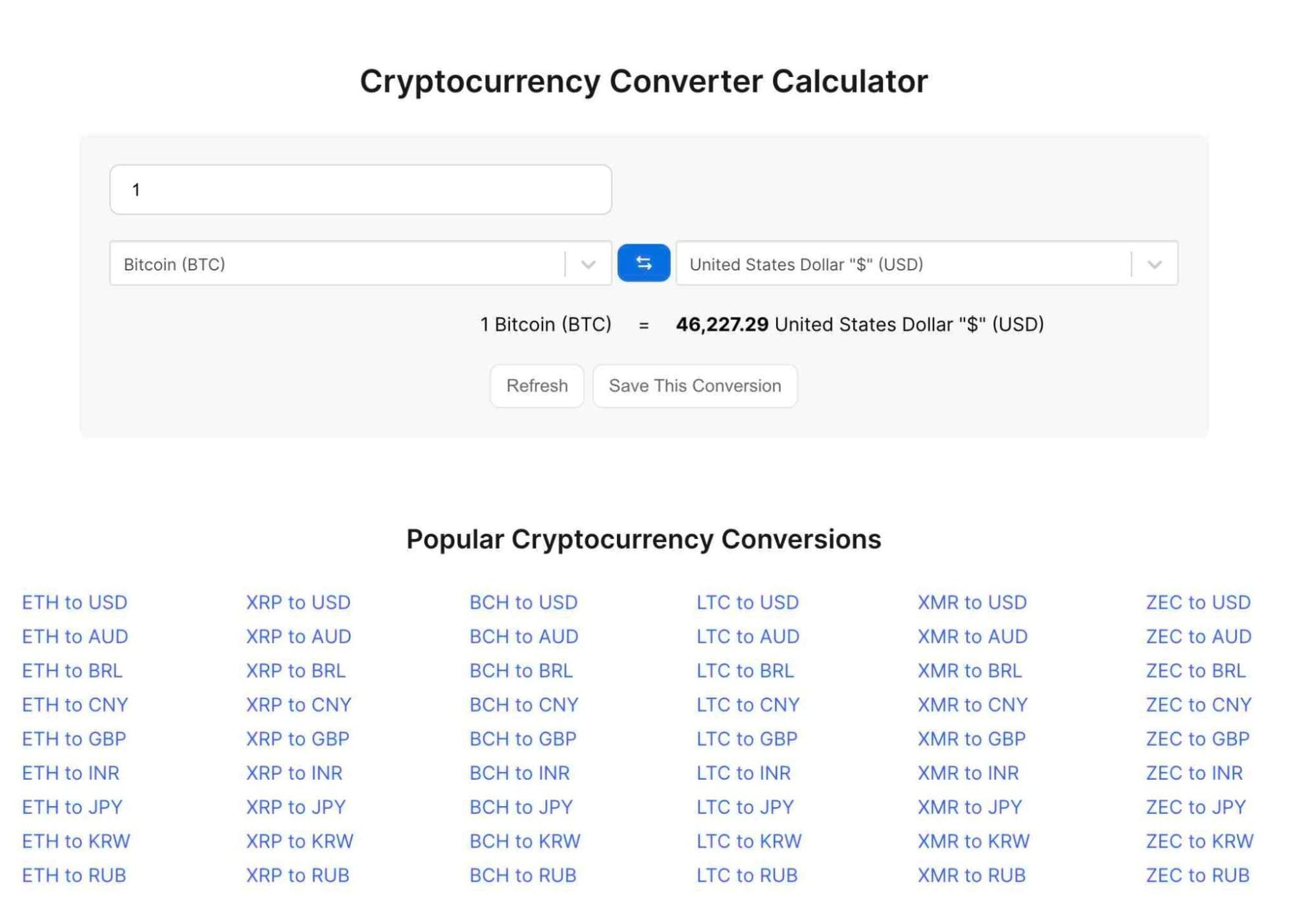

CryptoTaxCalculator - Lowest cost at 39 with our 20 discount link CoinTracker - Most advanced crypto portfolio tracker. Using The Australian Cryptocurrency Tax Calculator. Trading or exchanging crypto.

Rated 46 with 700 Reviews. In order to use the cryptocurrency tax calculator effectively youll need to provide a number of specific details about. Quick simple and reliable.

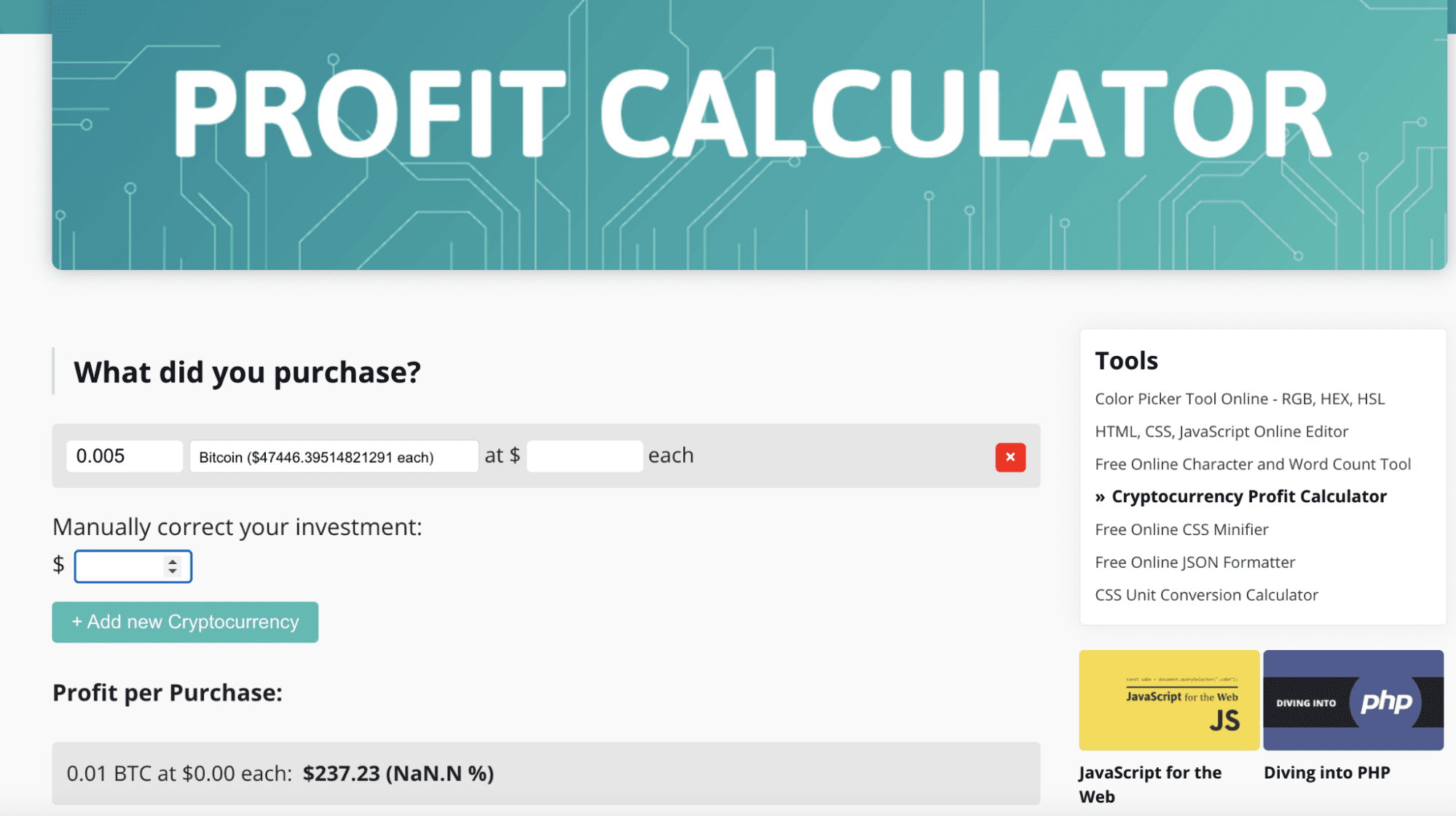

Our calculator allows you to calculate your combined capital gains and losses for up to 5 cryptocurrencies at once. Crypto Tax Calculator for Australia NZ Australias Leading Crypto Tax Tool Calculate Your Crypto DeFi and NFT Taxes in Minutes. Thats just over 4 a month for your peace of mind when it comes to crypto tax in Australia.

Koinly - Biggest discount with our 30 discount link. Cryptocurrency Tax Calculator Australia. Australias first crypto accounting and tax tool which has been vetted by a Chartered Accountant.

In Australia although it is referred to as Capital Gains Tax there is no separate tax and any gains you make will be assessable income subject to Income Tax. To work out your capital gain or loss you need to determine the value of your cryptocurrency purchases and sales in Australian dollars. Swyftx makes it easy with their easy to use interface and the following features.

Cryptocurrency can be an challenging field to get into and considering that it has been popular for a few years now it can be challenging to know where to jump in. Welcome to the best crypto tax calculator application in Australia. Were here to help you navigate your.

The world of cryptocurrency and taxation is a murky one. These have been explained below. If you want to work out your profits for more coins click the Add Coin button and fill out the relevant fields for the additional coins.

TokenTax - Supports data from every exchange and wallet. Save 70 on accounting fees by providing them auto-generated document. How to use our Australian crypto tax calculator Our crypto tax calculator estimates how much CGT you would have to pay when you sell or swap your cryptocurrency asset.

Cost base cost of ownership including the purchase price plus certain other costs associated with acquiring holding and disposing of it. To use this calculator youll need to provide a few details about your crypto asset. CoinLedger - Best crypto tax software overall.

A capital gain or loss is the difference between the. Selling cryptocurrency for fiat currency such as the Australian dollar is a taxable event according to the ATO. Well Crypto Tax Calculator Australias plans and pricing are extremely affordable and versatile so you can choose the plan that works best for you based on your trading history.

After the first year its 50. There are no limitations on the data source and you can import data from anywhere. TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange.

The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of. In the initial year a 100 Capital Gains Tax will be levied on profit made from the sale of cryptocurrencies. BearTax - Excellent for high-frequency traders and trading.

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How To Calculate Crypto Taxes Koinly

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Coinledger Australia S 1 Crypto Tax Software

Bitcoin Price Prediction Today Usd Authentic For 2025

Best Cryptocurrency Calculator Mining Profit Taxes

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Cryptocurrency Tax Calculator Forbes Advisor

Crypto Tax In Australia The Definitive 2022 Guide

Best Cryptocurrency Calculator Mining Profit Taxes

Cryptoreports Google Workspace Marketplace

Best Cryptocurrency Calculator Mining Profit Taxes

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Cryptocurrency

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining